Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

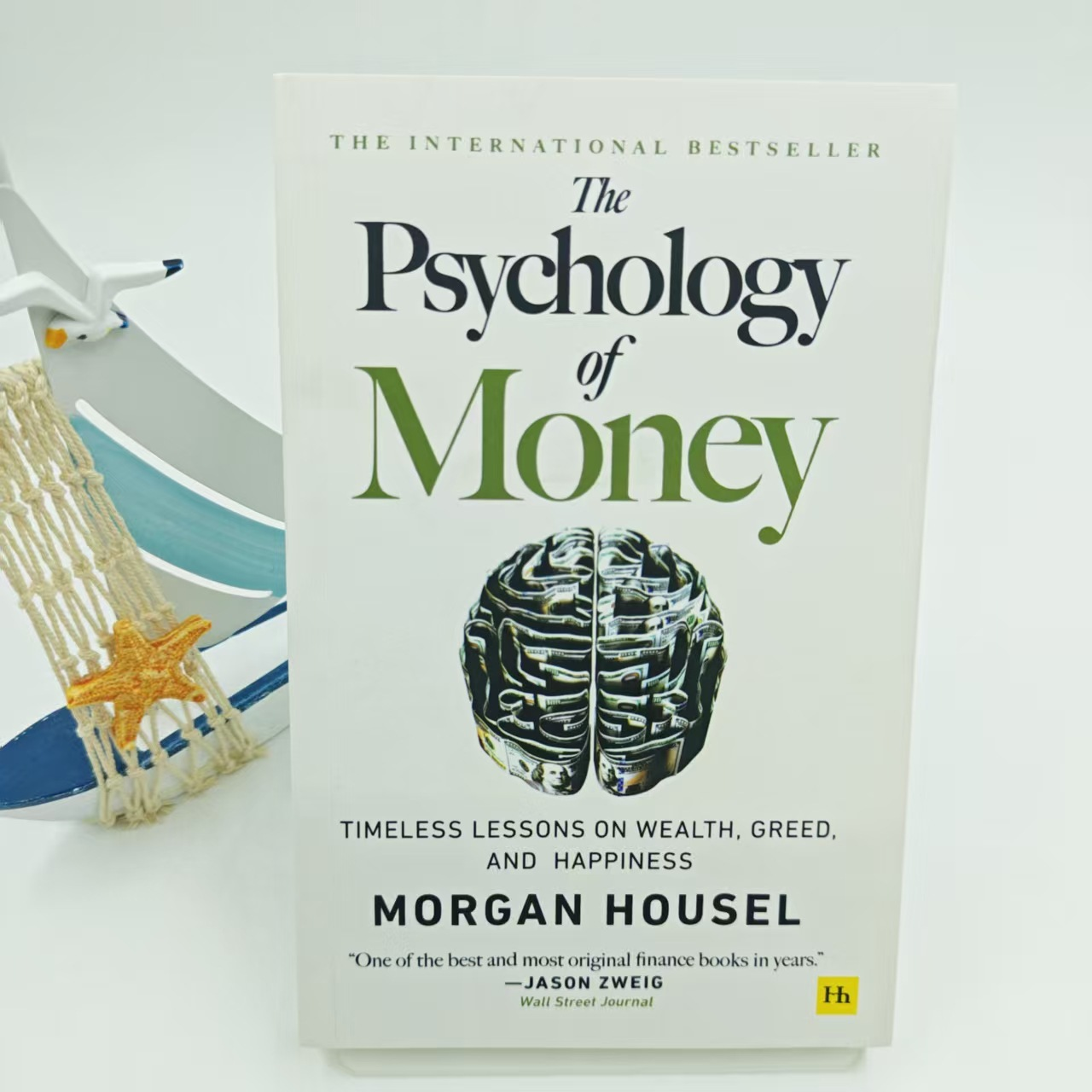

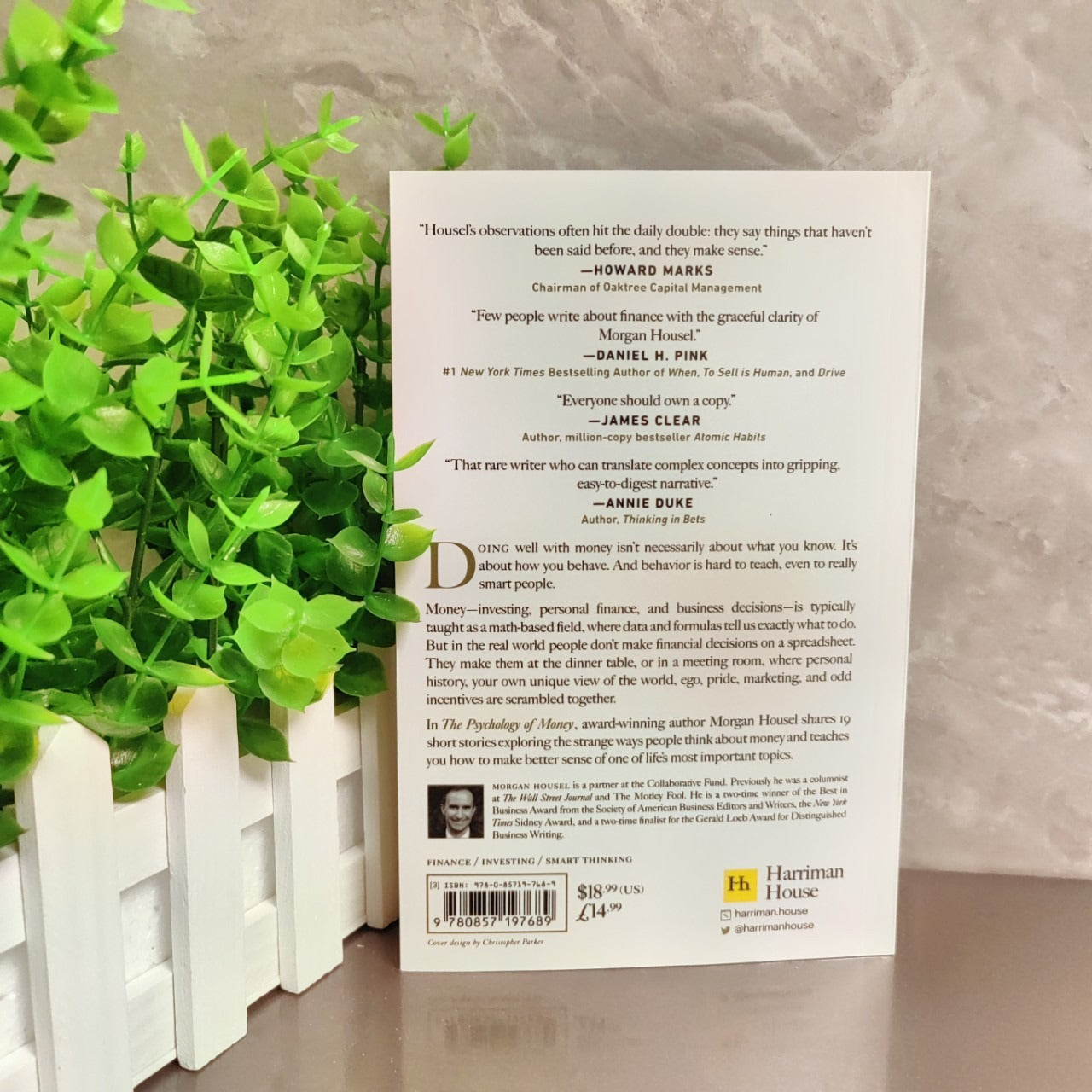

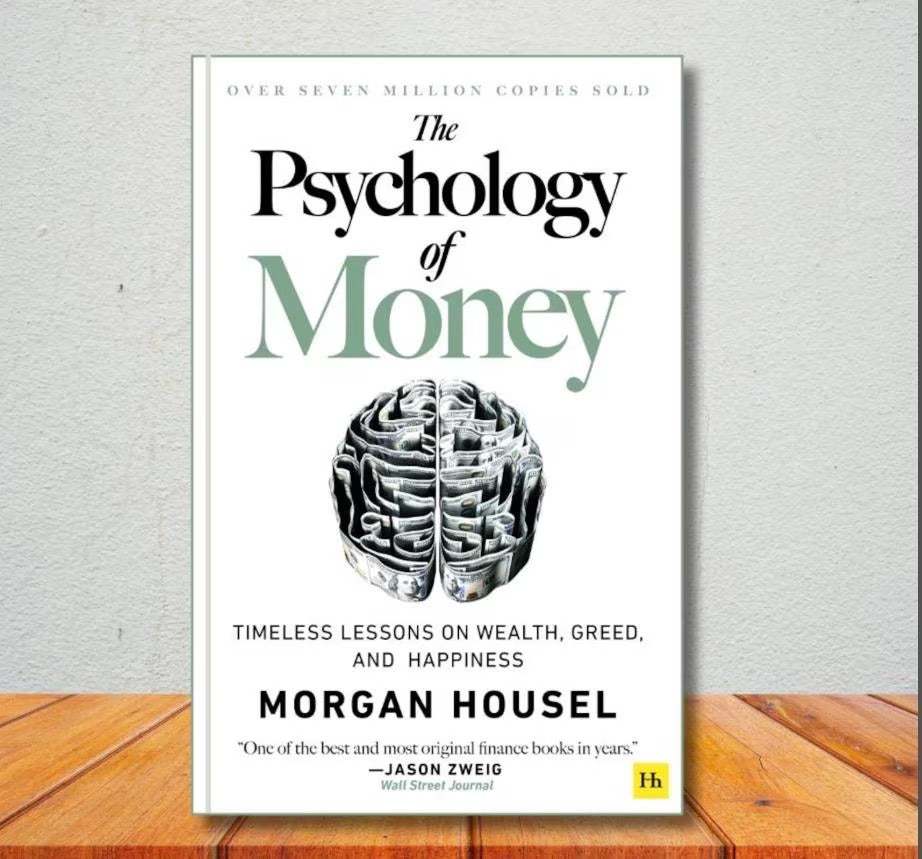

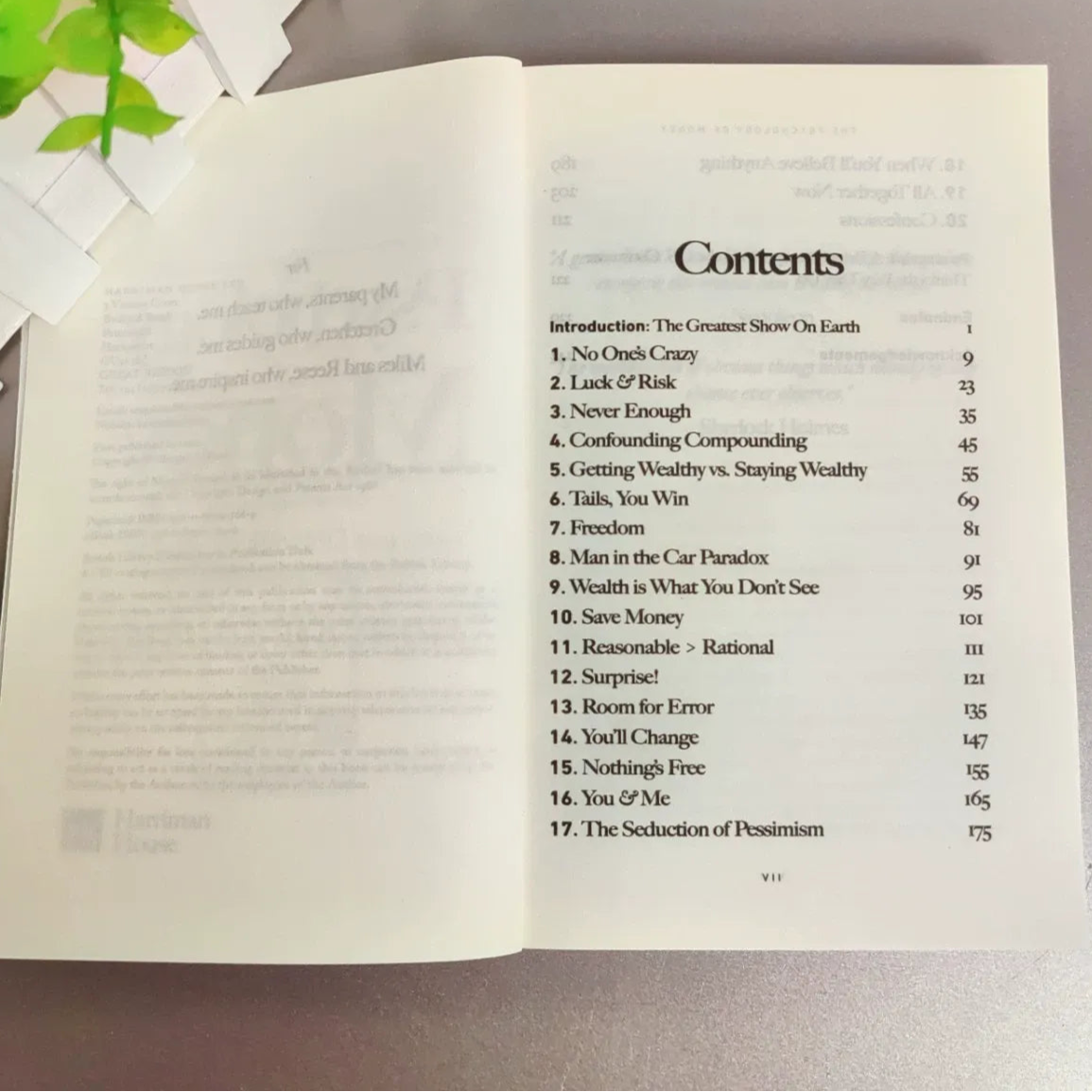

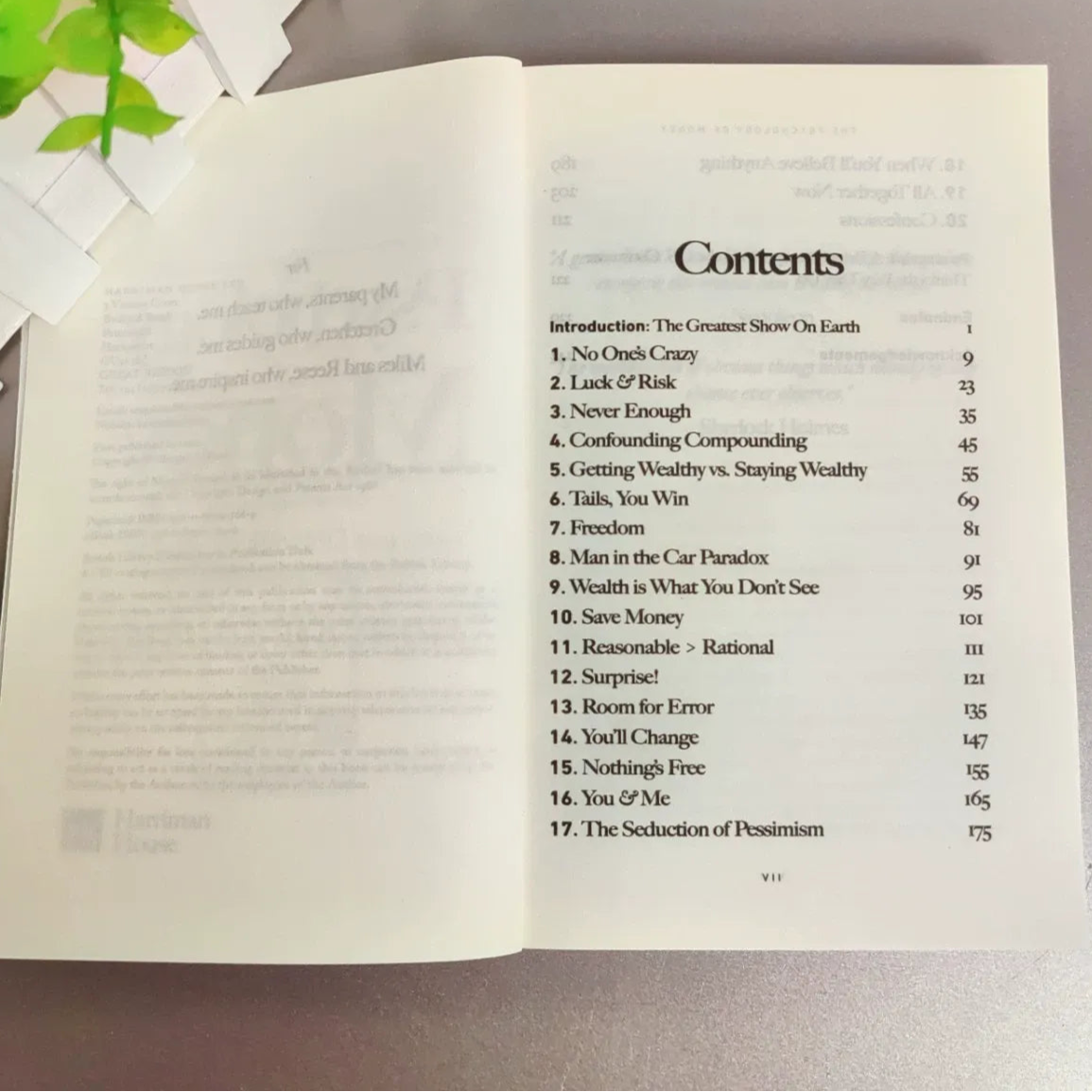

The Psychology of Money: Unlock the Hidden Rules of Wealth & Happiness

Forget dry finance formulas—this book dives into the human side of money, showing how your thoughts, habits, and emotions shape your financial life. A must-read for anyone who wants to build wealth without sacrificing peace of mind.

This book debunks the lie that “more income = more wealth” or “you need to be good at numbers to succeed.”

It reveals how simple, counterintuitive habits (like patience over greed) matter more than complex strategies—making finance accessible to everyone, regardless of expertise.

Breaks Money Myths: It’s Not Just About Math

Real-Life Stories: Relatable, Not Abstract

- No jargon or hypothetical examples—just true stories of people who built (or lost) wealth through their mindset.

- From a teacher who retired wealthy on a modest salary to a millionaire who struggled with overspending, these tales make big financial lessons feel personal and actionable.

Teaches Emotional Control: Master Your Money Mindset

- Money stress often comes from emotions, not numbers.

- This book shows you how to avoid impulse buys, ignore “get-rich-quick” hype, and stay calm during market crashes—helping you make decisions that align with long-term goals, not short-term feelings.

For Everyone, Not Just “Finance People”

- Whether you’re living paycheck to paycheck, saving for a home, or already wealthy, this book has value.

- It focuses on universal truths (like “wealth is freedom, not status”) that apply to all income levels—no prior finance knowledge required.

Practical Takeaways: Turn Insights Into Action

- Each chapter ends with simple steps you can take today: how to set “money goals that matter,” how to avoid comparing your finances to others, and how to build a budget that feels flexible (not restrictive). It’s not just a book to read—it’s a guide to live by.

Morgan Housel: The Mind Behind The Psychology of Money

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Breaks Money Myths

Real-Life Stories

Master Your Money Mindset

For Everyone, Not Just “Finance People”

Practical Takeaways

Why Choose us

Our book has clear advantages over others.

|

Others | |

|---|---|---|

| Breaks Money Myths | ||

| Real-Life Stories | ||

| Master Your Money Mindset | ||

| For Everyone, Not Just “Finance People” | ||

| Practical Takeaways |

Real Feedback From Real Customers

“Money is a tool. This book teaches you how to use its psychology, not just its math.”

96%

The content of the book is very authentic and solves my financial problems.

94%

The quality of the book is very good and solid.

92%

Effectively solving economic problems and helping cultivate good money habits.

Loved by 12,000+ Customers

Common FAQs

Q: Is this book helpful for teenagers learning about money?

Q: Is this book helpful for teenagers learning about money?

A: Yes! It uses simple language and relatable stories (no complex terms) that teach basic money mindsets—great for teens building early habits around saving, spending, and goal-setting.

Q: Does the book include advice for investing, like choosing stocks?

Q: Does the book include advice for investing, like choosing stocks?

A: No, it focuses on psychology (e.g., avoiding greed/fear) rather than specific investing tips. It helps you make better choices about money overall, not pick individual investments.

Q: Can I read this book if I already have a good handle on my finances?

Q: Can I read this book if I already have a good handle on my finances?

A: Absolutely. Even with solid finances, it deepens understanding of your money biases (e.g., why you compare spending to others) and helps protect long-term wealth from emotional mistakes.

Q: Is this book suitable for group or team reading (e.g., families, work teams)?

Q: Is this book suitable for group or team reading (e.g., families, work teams)?

A: Yes! Its short chapters and universal money topics (e.g., patience, avoiding comparison) make it perfect for group discussions. Families can use it to align on financial values, while teams can explore how money mindsets impact work decisions.